Financial literacy courses for kids age 7 to 13

Just in a few months your child will learn how to manage and save money, work with bank loans and investments all in interactive story-driven format.

TRY DEMO NOW FOR FREEFast development of financial literacy basics

In a couple of months of studying just one hour per week your child will be able plan his or her finances, understand basic banking products and develop a remarkable level of financial literacy.

Unit 1.

Fundamentals of Economics and Financial Literacy

As a part of this unit your child will learn the basics of economics: the mechanisms of market relations, need for income, what money is and why it's necessary, the origins of finances and global currencies.

Unit 2.

Financial management: personal budget

As a part of this unit, your child will understand the elements of personal budget, obtain core financial skills and habits, learn how to manage expenses and income, set and effectively plan to achieve a financial goal.

Unit 3.

Financial management:

family budget

As a part of this unit, your child will understand what family budget consist of, what income and expenses are in family format, how large purchases are planned etc.

Unit 4:

Banking products and financial instruments

As a part of this unit your child will understand how the bulk of banking products, such as loans and deposits, works, as well as how to use financial instruments such as stocks or bonds and how to avoid getting into debt.

Unit 5.

Entrepreneurship and corporate economics basics

As part of the unit, your child will understand how companies work, what their expenses and incomes consist of, how they set prices for their goods, how they provide profits and what rules the market abides by. Also, the child will try on the role of company CEO in the game.

According to research many Americans struggle to make ends meet due to poor financial literacy.

78% of adults live paycheck to paycheck

Living paycheck to paycheck means you are spending most or all of your monthly income on expenses. Once essentials are paid, there's no money left over for savings.

72% of adults mention finances as a significant source of their stress

72 percent of Americans reported feeling stressed about money at least some of the time during the past month. And finances are the top-1 stress source of all listed.

60% of adults had credit card debt in the past year

Six out of ten U.S. adults had credit card debt in the past year. And nearly two in five indicate that they carry balances from month to month, resulting in interest and late fees.

Less than one in 5 adults is confident in their future

Despite the fact that most are saving at least something for retirement, fewer than 1 in 5 U.S. adults feel very confident – and over 1 in 4 are not confident at all – that they are saving enough.

54% of millennials are concerned about student loans

When asked about their ability to repay their student loan debt, more than 54% of Millennials expressed concern.

source

27 states scored a C, D, or F for high school financial literacy

Champlain College's Center for Financial Literacy, using national data, has graded all 50 states on their financial literacy education, only five states earned an A. Sadly, 27 states received grades C, D or F.

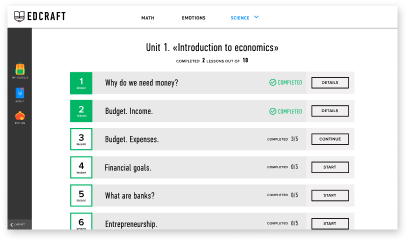

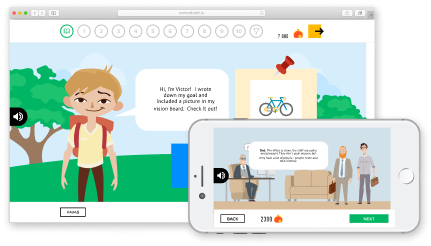

EdCraft game-courses free demo

Unit 1. Fundamentals of Economics and Financial Literacy

Check out our story-driven interactive courses

that your kids will face in Financial literacy courses.

Free of charge. No signup required!

Why should you start helping develop financial literacy early?

Contribution to the successful

future of your child

Financial literacy is an important skill in the modern society that has to be developed in early childhood. This is not going to be taught in school.

Smart approach

to financial products

In the modern world a child has to know and be able to correctly apply for financial instruments along with using all the possibilities of the market economy.

Logic and critical

thinking development

While developing financial literacy your child acquire another valuable skill of establishing causes of events and understanding cause-and-effect relationships.

Precise calculations

and strategic thinking

Your child will also learn how to develop and achieve financial goals together with anticipating and calculating risks.

What topics do we cover on our course

Global currencies and exchange rates

Should kids receive money for the “A” grades

What does the family budget consist of

How to build and manage personal and family budgets

How to set and reach a financial goal

Cybersecurity, How to recognize a fraud

Occasional purchases and financial cushion

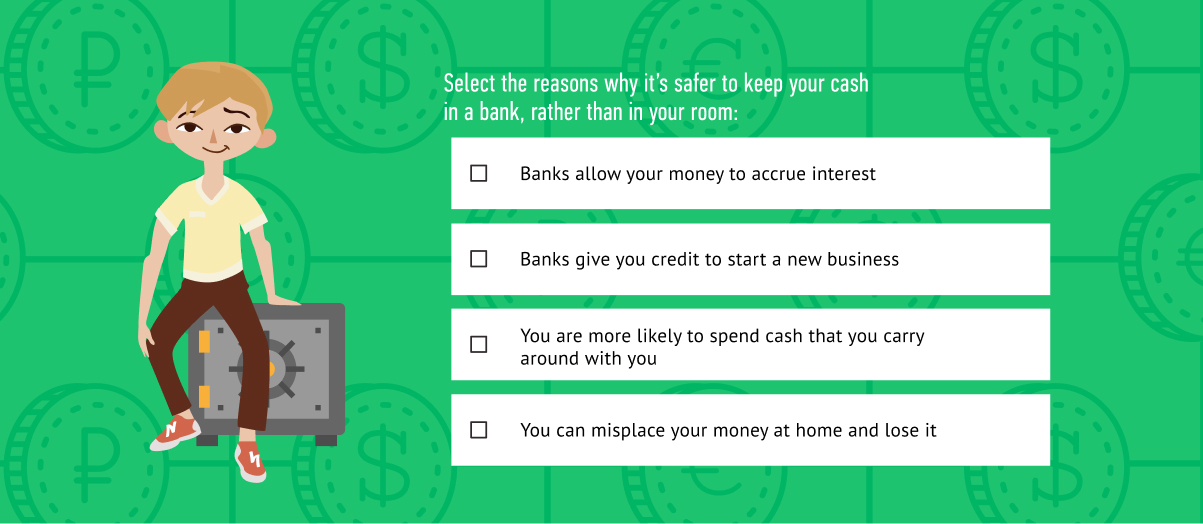

Banking products, loans and deposits

Financial market, investments and risks

Entrepreneurship and corporate economics basics

Pocket money and a first bank card

How to distinguish a pyramid scheme

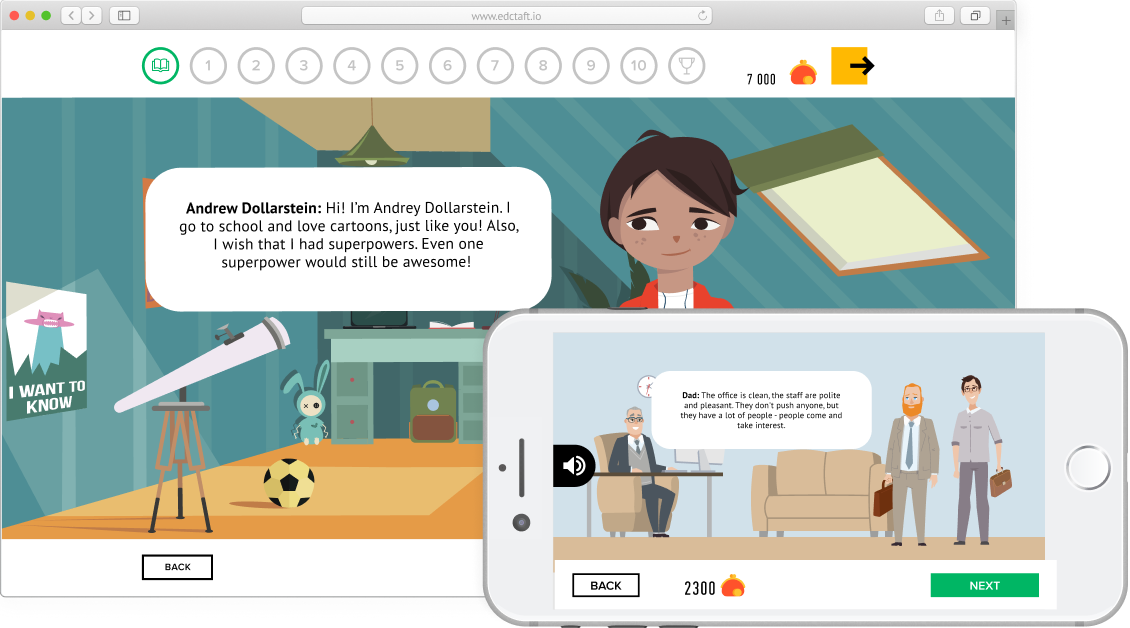

10 interactive game-lessons

30-40 minutes each

But you can split it as you want, start from even 5 minutes a day! Each lesson - one topic, for example, about the financial security, savings or investments.

Unlimited full access

to all materials

Your kids will be able to take the course as many times as they want or need. You buy the course once and you can return back even after 5 years.

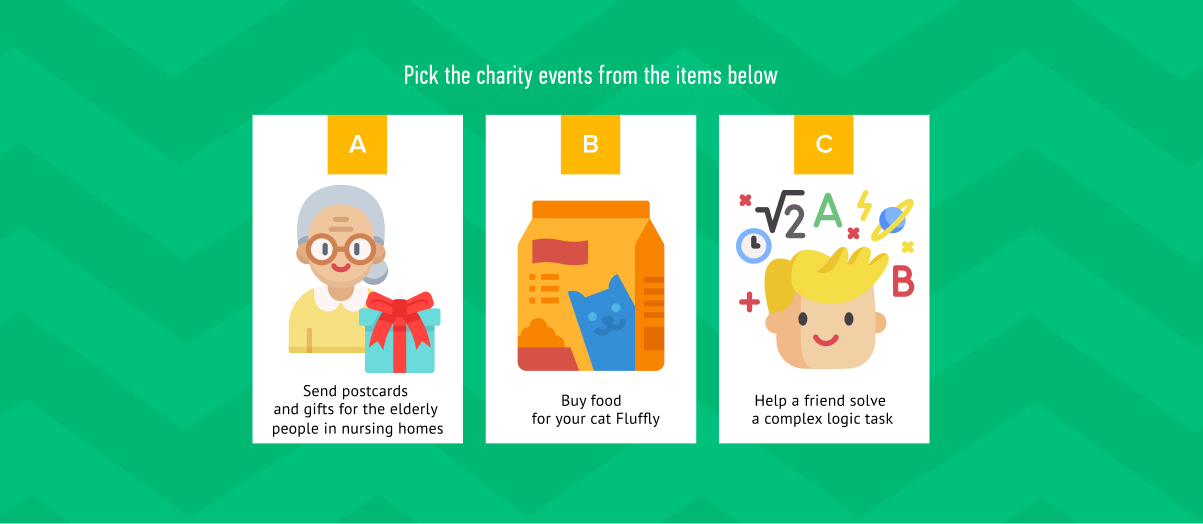

50 interactive

story-driven tasks

Each lesson contains 5-7 tasks to consolidate the material covered. All tasks have a plot and gorgeous illustrations, or are presented in the form of a game.

Final test with diploma

as a reward

At the end of each stage, the child takes a test or completes a game, receiving a certificate if successful. That's gonna be great addition to your portfolio!

In financial literacy courses kids solve game tasks that help them to understand finances and business

Carefully crafted by

experts in kids education

Courses are developed by subject experts from top US and international universities. Our content creators are doting parents, committed educators, and lovers of learning!

START FREE TRIALIn EdCraft kids master their financial skills by solving games that motivate them and support individual traction

SOPHISTICATED PROGRAM

Units are developed on the basis of the best sources, the expertise of methodologists and psychologists, divided into 10 lessons with gamified tasks

INTERACTIVE GAME STRUCTURE

The child solves plot game problems to learn new topics and consolidate what he has learned in each course. No boredom! All the tasks are unique!

KNOWLEDGE TESTS AND REWARDS

At the end of each course, the child takes a test or completes a game, receiving a diploma if successful. You will be confident in her kid’s knowledge!

What else do we have in EdCraft?

Complete by yourself or together with your kid. It's fun, educational and takes only up to 10 minutes for the demo lesson.

MATH & LOGIC

develop a mathematical mind through game like exercises

CHEMISTRY BASICS

explore the world of particles through gamified experiments

PHYSICS BASICS

learn in a simple way how objects and forces interact

EMOTIONAL INTELLIGENCE

learn to Improve communication and teamwork

FINANCIAL LITERACY

getting familiar with managing money in a fun way

SEX EDUCATION

topics covering relationships without awkwardness

User reviews

Check out the feedback left on TrustPilot by our early users

US

US