Financial games for kids

7-13 years old

Just in a few months your child will learn how to manage and save money, work with bank products and investments — all in interactive game format.

Financial literacy basics in interactive game format

With the help of exciting financial games, just in a couple of months your child will be able to plan his or her finances, understand basic banking products and develop a remarkable level of financial literacy.

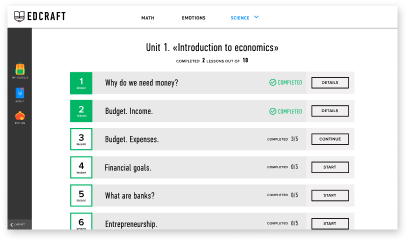

Level 1. Fundamentals of Economics and Financial Literacy

As a part of this level, your kid will take in fundamentals of economics such as the definition of money, foreign currencies, income, and market. He or she will also learn where the money came from and why it is necessary in an interactive game format.

Level 2. Financial management: personal budget

As a part of this level, your kid will understand the necessity of personal budget, learn how to form and use it. With engaging video and audio materials, he or she will set a personal financial plan for a hypothetical month, considering his/her income.

Level 3. Financial management: family budget

As a part of this level, your kid will learn the basics of family budgeting, including the amount of expenditure planned, large purchases, etc. Financial games at this level are aimed at explaining how a family budget is formed and why it is necessary.

Level 4: Banking products and financial instruments

As a part of this level, your kid will learn about basic banking products such as loans and deposits, how to use them wisely and avoid getting into debt. To make some complicated terms easier, we created easy-to-follow explanations in a game form.

Level 5. Entrepreneurship and corporate economics basics

As a part of this level, your kid will research work of big companies, market rules, consistency of expenses and incomes. What is more, we have prepared a game where a child will act as a company director, choosing a suitable market strategy.

Try EdCraft financial games for free

FINANCIAL GAMES FOR KIDS DEMO

Check out our interactive financial games by yourself or together with your child. It only takes 10 minutes and does not require registration.

Free of charge. No signup required!

Why should you start helping develop financial literacy early?

Makes a basis of a child's future success

Nowadays, financial literacy is one of the most critical skills contributing to a child's future success. The earlier children begin to learn it, the more competitive they become later.

Enables children to use financial products wisely

It is highly significant for today's children to know how to apply for financial instruments correctly. We mostly live in the market economy and should know how to use it.

Develops children's logic and critical thinking

While learning the financial basics, a child will also train critical thinking and establish causal relationships. These skills come side by side and should be taken into consideration, too.

Trains mathematical and strategic thinking

Financial literacy includes the development and achievement of financial goals alongside calculating potential risks. This will help your kid to learn how to strategize and use his/her knowledge.

What topics do our financial games cover?

What is money and why is it needed?

Personal budget: income and expenses

Family budget: what does it consist of?

Financial goals and planning

Occasional purchases and financial cushion

How to choose the best price?

Pocket money and the first bank card

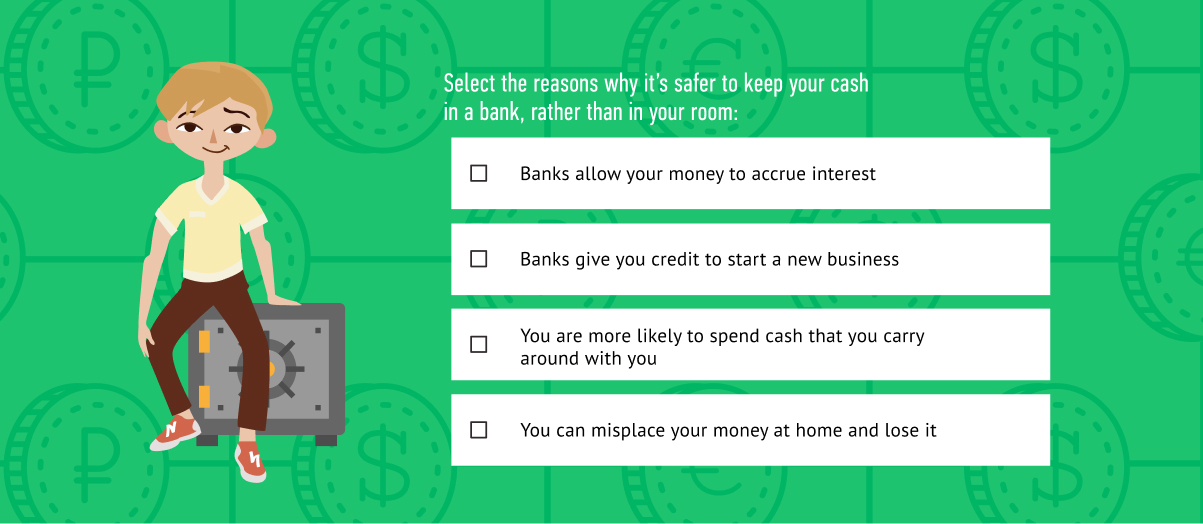

Banking products: deposits and loans

How to protect yourself from fraudsters?

Government and finance: what are taxes?

Financial market and investments

Entrepreneurship and business basics

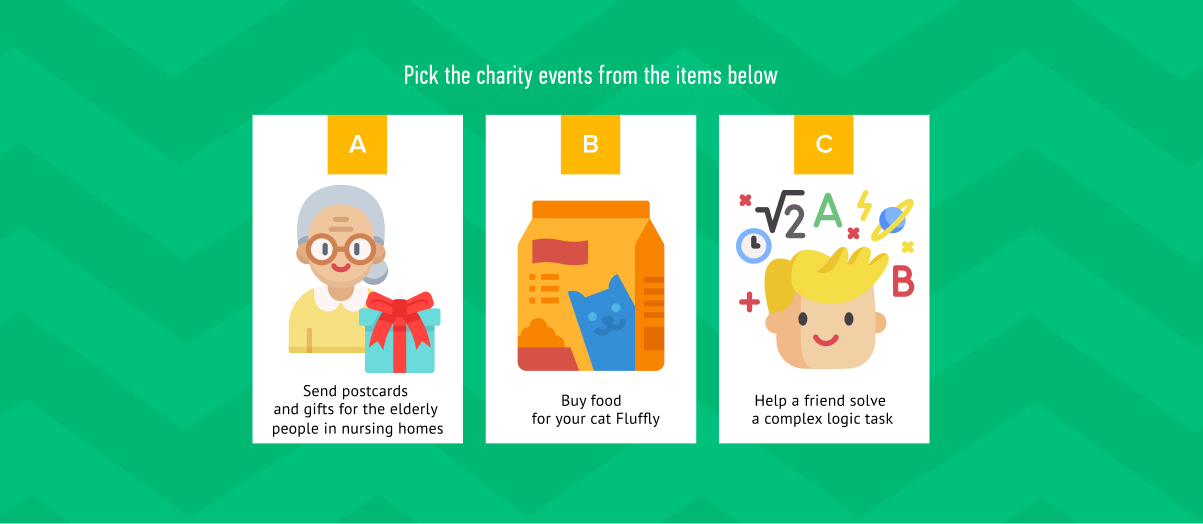

In EdCraft kids solve gamified tasks that help them to understand essential topics of economics, finance and business

Carefully crafted by

experts in kids education

Financial games are developed by subject experts from top US and international universities. Our content creators are doting parents, committed educators, and lovers of learning!

START FREE TRIALIn EdCraft kids master their financial skills by solving games that motivate them and support individual traction

WELL THOUGHT-OUT PROGRAM

Games are developed on the basis of the best sources, the expertise of methodologists and psychologists.

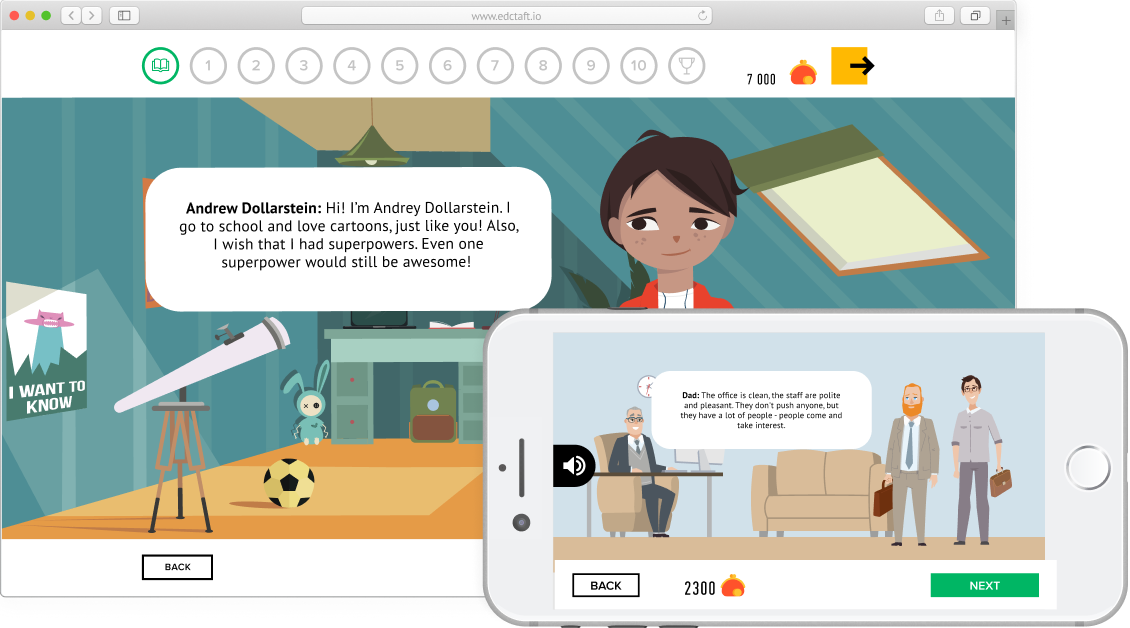

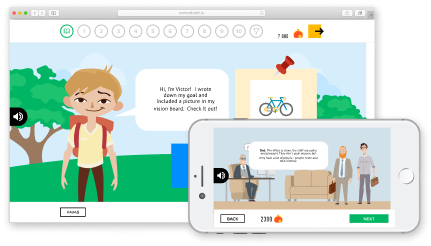

INTERACTIVE GAME STRUCTURE

The child solves plot game problems and helps the heroes of the game with real-life financial issues.

KNOWLEDGE TESTS AND REWARDS

At the end of each topic, the child goes through a final game to test and consolidate knowledge and receives a diploma if successful.

What is financial literacy, and why is it important?

Financial literacy is a broad term that includes efficient money management, personal and family budgeting, investing, and entrepreneurship. It is the basis of your relationship with money which is getting deeper through the lifetime. That is why it is highly significant to begin this journey as early as possible — this will give you a strong foundation in your future economic life. Every modern person has to distinguish between types of loans, form a monthly financial plan, know how to save money, etc. Without this knowledge, frauds could cheat on you easily, and what is more, you will not fulfill your financial potential if you manage your money thoughtlessly.

Why is financial literacy worth learning from childhood?

Nowadays, children become independent pretty early, so they'd better be prepared for the peculiarities of the market economy. This will give them the ability to manage their pocket money wisely and responsibly and make them confident when they plan to buy something pretty expensive. When they meet the economic system face to face in their teens, they will already have all the necessary tools to interact with it. Sure enough, there is no need to give a kid a huge student's book with plenty of complicated terms and problems. The best way to start financial literacy studying is to go for an interactive game format with funny stories and audio-visual materials.

Why are financial games the best way to introduce your child to finance?

This method is effective as learning and playing at the same time keeps a kid away from boredom and loss of concentration. Moreover, financial literacy games allow children to share this experience with each other, which gives them an opportunity to reinforce new knowledge and, as well as that, strengthen bonds between peers. Another crucial reason to choose this way of learning is a chance to experience the consequences of poor management in a safe environment. In other words, educational financial games let your child learn from his/her mistakes without actual loss of money, though it is an imitation of a real-life situation.

How can Edcraft help?

Edcraft has developed a perfect format for children of 7-14 years old. Just in a few months, your child will learn how to use bank products, save and invest money, and manage his/her personal budget. Story-driven learning allows children to solve real-life problems in an entertaining form. By the way, you can play our interactive financial games on any device (smartphone, tablet, or PC) and spend as much time as you find the most comfortable — even 10 minutes will be beneficial. Although our games are created by experts from the top world universities, they are easy for children of any age as everything is explained simply and with relevant examples. At the end of the course, a final game enables a child to gain his/her diploma.

What else do we have in EdCraft?

Complete by yourself or together with your kid. It's fun, educational and takes only up to 10 minutes for the demo lesson.

MATH & LOGIC

develop a mathematical mind through game like exercises

CHEMISTRY BASICS

explore the world of particles through gamified experiments

PHYSICS BASICS

learn in a simple way how objects and forces interact

EMOTIONAL INTELLIGENCE

learn to Improve communication and teamwork

FINANCIAL LITERACY

getting familiar with managing money in a fun way

SEX EDUCATION

topics covering relationships without awkwardness