Money management for kids

Just in a few months your child will learn how to manage money, work with bank products and make smart financial decisions — all in interactive story-driven format.

TRY DEMO NOW FOR FREEFast development of financial literacy basics and money management skills

In a couple of months of studying just one hour per week your child will be able plan his or her finances, understand basic banking products and develop a remarkable level of financial literacy.

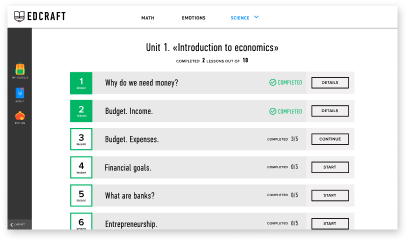

Unit 1. Basics of Financial Literacy and Economics

As a part of this unit, your child will understand basic terms of economics: from finances’ origins to their national diversity; from definitions of income and outcome to mechanisms of market relations.

Unit 2. Financial management: personal budget

As a part of this unit, your child will learn how to manage his/her expenses and income, what elements should be concerned while budgeting, and what habits can help him/her achieve financial goals.

Unit 3. Financial management: family budget

As a part of this unit, your child will explore the consistency of the family budget, the algorithm of planning large purchases, and also learn how income and expenses are calculated in family format.

Unit 4. Banking and financial instruments

As a part of this unit, your child will take in the concept of banking products, what types of them he/she can get and how they work, as well as how to use them wisely without getting into debt.

Unit 5. Basics of entrepreneurship and corporate economics

As a part of this unit, your child will learn about the work of different companies, their expenses and incomes, prices, and profits, and also try on the role of a company CEO in the game.

Try EdCraft money management game courses for free

Kids Money Management Online

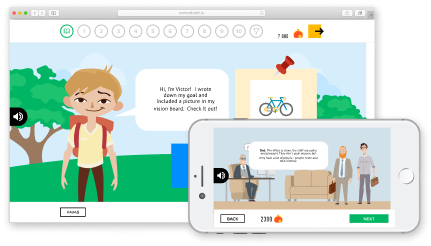

Check out our story-driven interactive game tasks

that your kids will face in Money management courses.

Free of charge. No signup required!

Teaching children money management:

Instill self-discipline

Money management skills make your kid responsible and rational about his/her personal finances, which is beneficial both in the present and future.

Give useful information

This knowledge is not usually taught at school. However, it is highly important in everyday life, so the earlier a kid learns it, the more profit he/she gets.

Prepare for adulthood

Nowadays, children become mature pretty quickly, so they’d better be sensible by the time they get a right to use banking products to avoid financial trouble.

Make a kid financially literate

Financial literacy is a crucial skill today because it helps us to avoid different kinds of frauds and cheats — forewarned is forearmed, as they say.

Only useful knowledge and essential money management skills

What is money and why is it needed?

Personal budget: income and expenses

Family budget: what does it consist of?

Financial goals and planning

Occasional purchases and financial cushion

How to choose the best price?

Pocket money and the first bank card

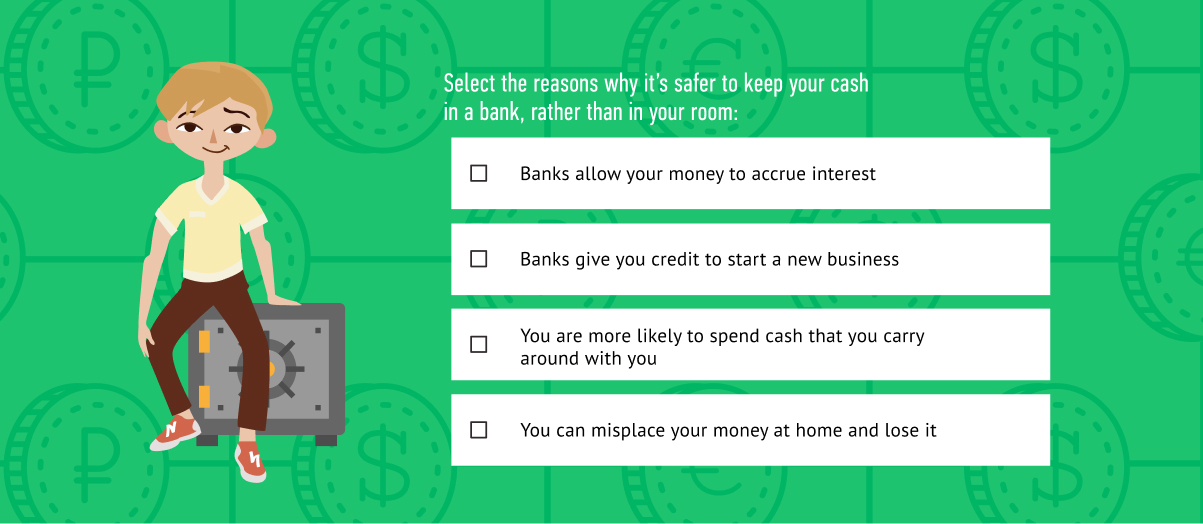

Banking products: deposits and loans

How to protect yourself from fraudsters?

Government and finance: what are taxes?

Financial market and investments

Entrepreneurship and business basics

10 interactive game-lessons

30-40 minutes each

But you can split it as you want, start from even 5 minutes a day! Each lesson — one topic, for example, setting financial goals or using credit cards.

Unlimited full access

to all materials

Your kids will be able to take the lessons as many times as they want or need. You buy the course once and you can return back even after 5 years.

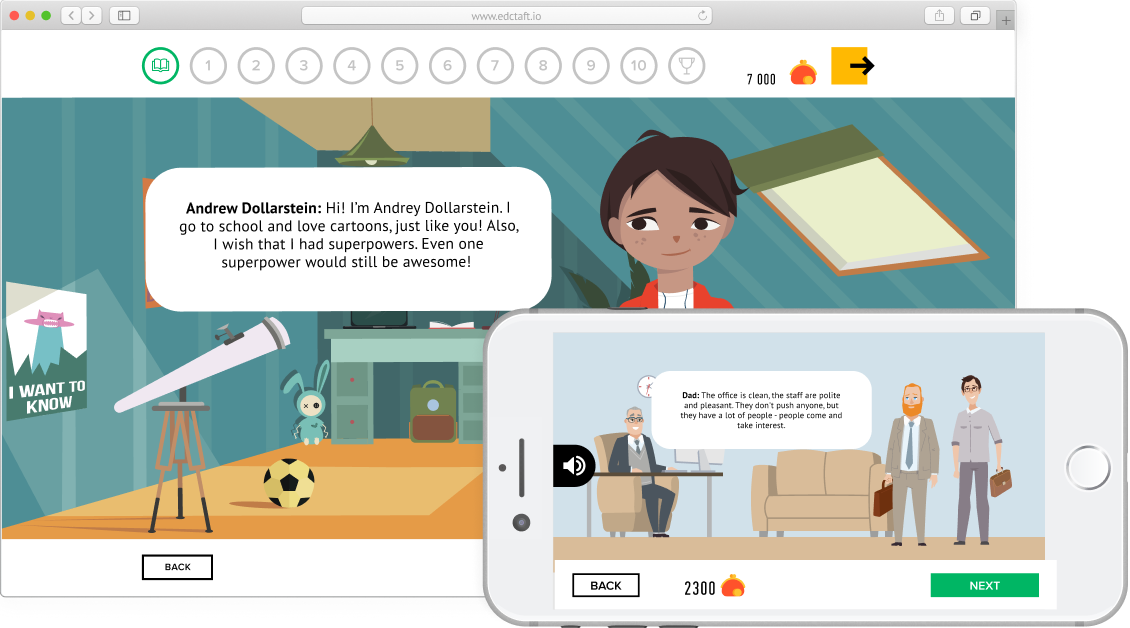

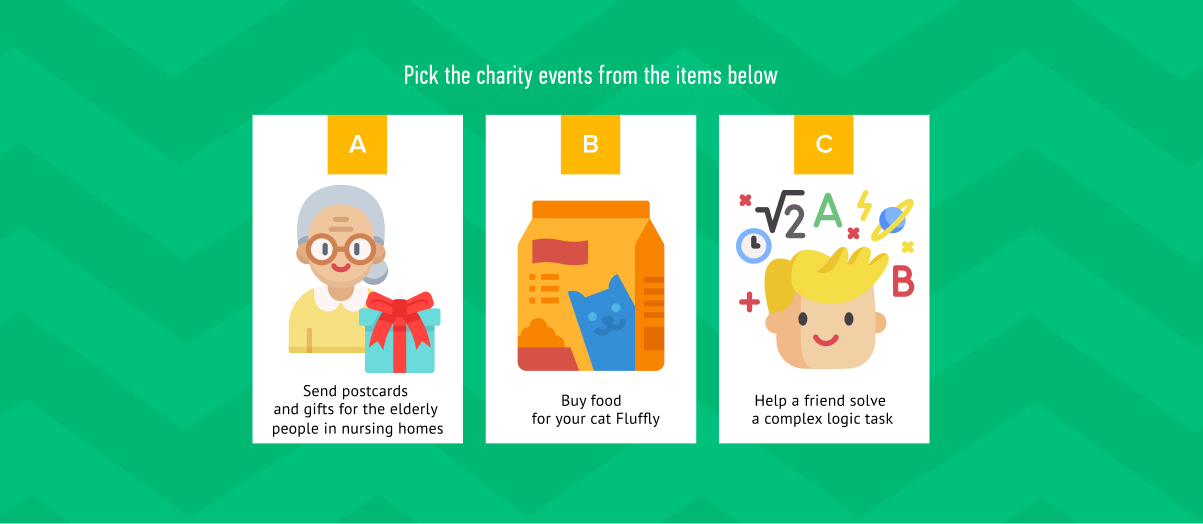

50 interactive

story-driven tasks

Each lesson contains 5-7 tasks to consolidate the material covered. All tasks have a plot and gorgeous illustrations, or are presented in the form of a game.

Final test with diploma

as a reward

At the end of each unit, the child takes a test or completes a game, receiving a certificate if successful. That's gonna be great addition to your portfolio!

In EdCraft money management lessons kids solve game tasks based on real-life situations

Carefully crafted by

experts in kids education

All money management lessons are developed by subject experts from top US and international universities. Our content creators are doting parents, committed educators, and lovers of learning!

START FREE TRIALHow to teach money management to kids?

These simple tips will help you teach your child how to manage money and make wise financial decisions.

1. Be a good example

Lots of modern studies agree that money habits in kids are usually formed by the time they turn 7 years old. Bear in mind that the youngsters are watching you whatever you do, whether it is about personal relationships, environment or financial issues. So, the best thing to do is educate yourself and transfer your knowledge to the children. If you have healthy financial habits, they will much more likely gather them too.

2. Stop impulsive purchases

Teens often tend to ask for some items spontaneously. Especially frequently, it happens when they use someone else’s money. One of the possible solutions is to offer your kid to use the money earned by him/herself. In other words, we pay extra money for extra purchases. Another way to go is to encourage your kid to wait for a day or two before buying something by impulse. He/she can take this time to make a wise financial decision.

3. Give your kid financial freedom

As soon as you explain to your kid that people earn money to buy the stuff they want, you can give him/her some weekly allowance. To keep it reasonable and at the most optimal level to cover your kid’s personal needs, you can raise the amount of money every year. An important point to consider is that you’d better give your children as much money as you can afford, not more. This will help you keep a record of your expenses and make your child plan purchases in advance.

4. Explain how money is made

Normally teenagers have several pretty long breaks during the year. They can use this time not only for resting but also to earn their own money in order to use it however they want. What is more, nowadays teenagers can even become entrepreneurs! Just imagine what kind of boost it would give your kid for his/her future career. Your task is to help your child find a field of interest and to support him/her all the way.

5. Start with physical currency

It is always easier to explain something when we can see and touch it. So, a great idea is to begin learning money management with cash. According to the age of the kid, you can teach him/her to put their coins in a piggy bank or keep paper money in designated envelopes. When a child has mastered cash-managing skills, it is time to talk about bank accounts: in what cases we use them and how to do it wisely. After a while, when a kid knows how to save money on the account, you can talk about different kinds of bank cards.

6. Teach about credit cards appropriately

Sometimes the topic of credits and loans is too complicated for a child. However, you can use different games and exciting stories to make it clearer. A teen can understand the concept of a loan in case you lend him/her money for a big personal purchase providing that he/she gives it back with interest by the due date. If a child misses the date, you can add a penalty cost to show a child how real financial relationships work.

In EdCraft kids master their money management skills by solving game tasks that keep them involved throughout the learning process

WELL THOUGHT-OUT PROGRAM

There are only the best sources used in our games, including the leading expertise of methodologists and psychologists.

INTERACTIVE GAME STRUCTURE

Real-life financial issues are packed into a plot-driven story where a kid should help a character solve them using new knowledge.

KNOWLEDGE TESTS AND REWARDS

At the end of each topic, a kid is offered to pass a test in a game format and receive a diploma if the answers are correct.

What else do we have in EdCraft?

Complete by yourself or together with your kid. It's fun, educational and takes only up to 10 minutes for the demo lesson.

MATH & LOGIC

develop a mathematical mind through game like exercises

CHEMISTRY BASICS

explore the world of particles through gamified experiments

PHYSICS BASICS

learn in a simple way how objects and forces interact

EMOTIONAL INTELLIGENCE

learn to Improve communication and teamwork

FINANCIAL LITERACY

getting familiar with managing money in a fun way

SEX EDUCATION

topics covering relationships without awkwardness